By Anne Anquillare, CFA, Head of CSC U.S. Fund Services

Like many other practices that grow up over time in an industry, the use of parallel funds, co-investments, side cars, blockers, SPVs (Special Purpose Vehicle), etc. have created their own set of complexities and unintended consequences. While they all have their roles in the investment structure, the expenses associated with these vehicles are not treated consistently across the industry, and these inconsistencies have the potential to create significant headaches for GPs. In light of a new set of rules being proposed by the SEC, it looks as though there will be no free ride when it comes to allocations of fees and expenses across vehicles managed by a private capital adviser.

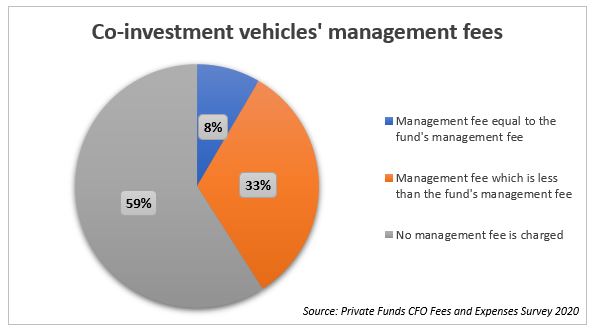

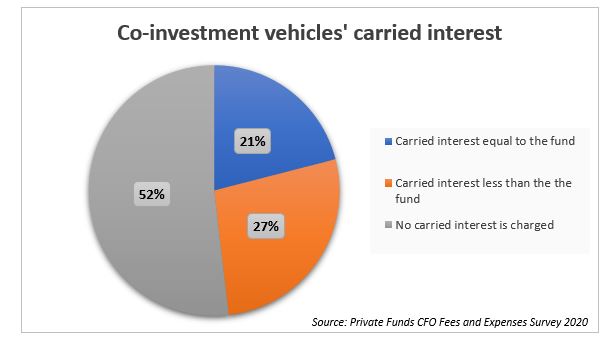

As a point of reference, in 2020, CSC conducted a survey of industry practices surrounding fees and expenses. Seventy-five percent of respondents used co-investment vehicles, but only 55% of those charged the vehicles organization and set-up costs. And when it comes to carry and management fees, the results range from “same as the fund” to “none”—as seen in the charts below.

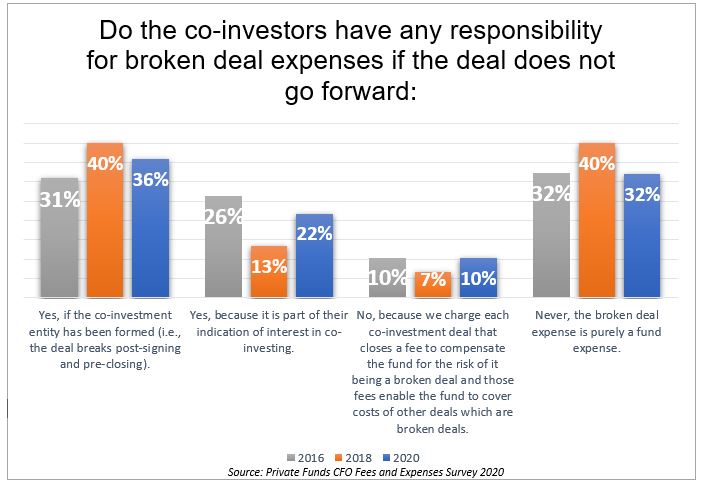

For broken deal expenses, across the six years we have conducted this survey, practices vary widely, as seen below.

In the proposed rules under the prohibited activities section, the SEC addresses the potential conflict of interest for the advisers with various vehicles, as well as the potential for preferred treatment of some investors at the expense (literally) of other investors. And this proposed rule applies to “…all advisers to private funds, regardless of whether they are registered…”.[1] The proposed rules prohibit non-pro rata allocations for any fees or expenses related to a portfolio investment that is held by multiple funds or vehicles, whether directly or indirectly managed by the adviser. The key term here is “allocations.” If the fund or vehicle’s document has direct fees and expenses (e.g., performance and management fees) that are disclosed in advance to investors, there is no allocation.

The concern arises when there are fees and expenses that are incurred due to an investment that is shared across funds or vehicles. There is also a concern that if a fund, and therefore its investors, is bearing more than its pro rata share of a fee or expense. (This is where an adviser needs to be careful with management fees if they are spending time and attention on other vehicles that have no management fees.)

The rationale for the SEC’s proposal is, “any non-pro rata allocation of fees and expenses under these circumstances is contrary to the protection of investors.”[2] And if a fund or vehicle cannot bear its own expense, the adviser could pay on behalf of the fund/vehicle or the adviser could allow “diluting such fund’s interest in the portfolio investment in a manner that is economically equal to its pro rata portion of such fee or expense.”[3] Talk about a rock and a hard place for the adviser. Best to make sure to have plenty of uncalled capital to avoid this situation.

And since “non-pro rata allocation in respect of unconsummated investments generally present the same concerns as discussed above with respect to consummated investments,”[4] the industry’s approach to broken-deal expenses is also likely to change.

While this proposed rule removes a potential conflict of interest for the adviser and preferential treatment of one client over another, it does bring some complexities, especially regarding unconsummated investments as well as investments made at different times.

The SEC has posed several important questions on this point. We encourage you to read them and work within your organization or industry associations on responses.

[1] SEC PRIVATE FUND ADVISERS; DOCUMENTATION OF REGISTERED INVESTMENT ADVISER COMPLIANCE REVIEWS; page 134

[2] SEC PRIVATE FUND ADVISERS; DOCUMENTATION OF REGISTERED INVESTMENT ADVISER COMPLIANCE REVIEWS; page 153

[3] SEC PRIVATE FUND ADVISERS; DOCUMENTATION OF REGISTERED INVESTMENT ADVISER COMPLIANCE REVIEWS; page 154

[4] SEC PRIVATE FUND ADVISERS; DOCUMENTATION OF REGISTERED INVESTMENT ADVISER COMPLIANCE REVIEWS; page 154