By Anne Anquillare, CFA, Head of CSC U.S. Fund Services

As we all spend more time reading through the U.S. Securities and Exchange Commission (SEC) proposed new rules for private fund advisers, it becomes obvious in the questions listed for comment that the SEC knows it is dealing with a dynamic industry. It recognizes that all parties involved need to balance regulator and industry requirements so as not to curtail the growth and innovation needed to support the investors and businesses relying on private capital markets for their success.

Before we get into what is being asked of the private capital advisers, let’s refresh ourselves on the role they play for investors. There is not an institutional investor in the world unaware of the need for alpha returns in their long-term portfolio to meet the goals of their constituents—this is just math. The key in traditional private capital investing is not expense management—it’s manager selection and return maximization. Once an adviser grows beyond the traditional private capital role and becomes an asset aggregator, then the focus for massive funds can shift to expense management as returns will revert to a mean.

That’s not to say investors shouldn’t care about expenses and their allocations, as these have been the main sources of frustration which erode trust in the private capital market. In the long term, the lack of trust stemming from bad behavior needs to be addressed, not the reduction of expenses (as clearly, with all this additional compliance, expenses will increase for traditional private capital firms). If anything, the focus on keeping expenses down, while moving to a more mature industry model, has led to the dramatic under-resourcing of compliance and reporting functions in our market and the situation we are in today.

So, let’s focus on the aspects of the proposed rules that will regain the much-needed trust of private capital market investors.

In this blog, we’ll focus on fees and expenses charged by private fund managers and related parties to their portfolio investments and why it’s important to leverage industry standards.

As mentioned in our previous blog (The SEC Private Fund Advisers Rule Proposal: How We Got Here), many closed-end private capital firms have tremendous resources they can bring to bear for portfolio investments. Many investors and portfolio companies recognize these resources as competitive advantages when selecting an adviser. That said, advisers who use internal or related parties must prove they provide these services at market level or above quality and market level or below cost. Why do they have this burden? Because there is an inherent conflict of interest and governance limitations that are part of the private capital market. It’s the fund’s manager (aka private capital adviser) in control of the contract with the portfolio investment. And while private capital firms typically have advisory committees that review conflict of interest situations, historically, this has not provided a source of strong governance. Investors are sensitive to crossing the line from inactive to active within the limited partner (LP) legal structure and they don’t want to have an antagonistic relationship with the fund’s management. Per the SEC “although some private funds may have limited partner advisory committees (LPACs) or boards of directors, these types of bodies may not have the necessary independence, authority, or accountability to oversee and consent to these conflicts or other harmful practices.”[1]

The good news is this isn’t a new issue for our industry, and industry associations have provided insightful options for a path forward. The SEC can leverage the work already done by these industry associations. For example, for real estate funds the National Council of Real Estate Investment Fiduciaries (NCREIF), Pension Real Estate Association (PREA), European Association for Investors in Non-Listed Real Estate Vehicles (INREV), and Asian Association for Investors in Non-Listed Real Estate Vehicles (ANREV) published the Total Global Expense Ratio principles and guidelines in November 2019. This document recommended a disclosure that “Where a manager charges a vehicle cost, the manager should perform a benchmark analysis to ensure the amount being charged is in line with market rates.”[2]

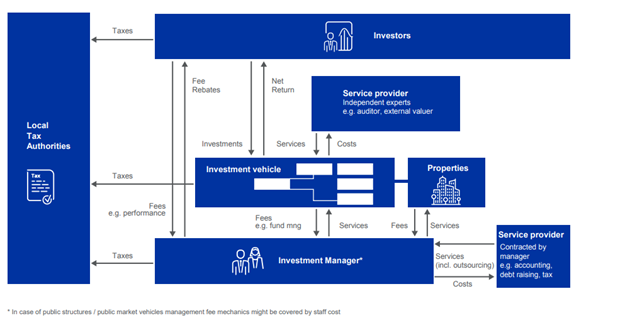

Leveraging industry standards will also help regulators understand the challenges faced by an industry when implementing standards. And if anyone has questions why the details of this regulation will be difficult, “the picture below provides an example of the different stakeholders and the flow of services charged to the vehicle and its investors”.[3]

Leveraging industry standards will also help regulators keep pace with industry changes. Similar to how FINRA leveraged the Global Investment Performance Standards when they stated: “…if it is calculated in a manner consistent with the Global Investment Performance Standards (GIPS®) adopted by the CFA Institute and includes additional GIPS-required metrics…”[4], the SEC can leverage standards that will save time and effort (and taxpayers’ money). It will also put a focus on industry participants to keep their industry standards up to date, lest we go the detailed regulatory route. This is where the service provider ecosystem of an industry is critical. In addition to investors and businesses benefiting from the growth of the private capital market, so to do its service providers. Dedicating time to industry standards is also where service providers can distinguish themselves as thought leaders and supporters of the long-term health and growth of our industry. At least that’s what I tell myself when I’m working on all these task forces and working groups.

So, what specifically is the SEC proposing regarding fees and expenses charged to portfolio investments?

- For registered advisers, for any portfolio investment that is charged a fee by the fund’s adviser or the adviser’s related parties, the following information must be provided for the reporting period in the quarterly report:

- Fund’s ownership in the portfolio investment and description of investment

While more clarity is needed for these proposed rules, the intent is clear:

- The SEC would like investors to have much more transparency on the expenses borne by their investments. Per the SEC, “…private funds are often more expensive than other asset classes because the scope and magnitude of fees and expenses paid directly and indirectly by private fund investors can be extensive.”[7]

- The SEC and investors are clearly fed up with what many would consider egregious economics for advisers being paid for services they don’t perform. Per the SEC, these fees and expenses “…typically reduces the value of investors’ indirect interest in the portfolio investment.”[8] and “…the receipt of such fees gives rise to conflicts of interest”[9]. These practices also lead to a lot of bad press the industry could do without.

For those firms that provide additional services to their portfolio investments and make these disclosures if the SEC adopts these rules, make sure you also describe to your investors how you benchmark your services to market rates and how your services provide value to the investment.

For next week’s blog, look forward to hearing more about additional aspects of the proposed rules that will regain the trust of investors in the private capital market they need so much—allocations of expenses across vehicles managed by a private capital advisers.

If you missed our previous blog, you can find it here The SEC Private Fund Advisers Rule Proposal: How We Got Here

[1] SEC PRIVATE FUND ADVISERS; DOCUMENTATION OF REGISTERED INVESTMENT ADVISER COMPLIANCE REVIEWS; page 13

[2] TOTAL GLOBAL EXPENSE RATIO: A GLOBALLY COMPARABLE MEASURE OF FEES AND COSTS FOR REAL ESTATE INVESTMENT VEHICLES, NOVEMBER 2019; page 18

[3] TOTAL GLOBAL EXPENSE RATIO: A GLOBALLY COMPARABLE MEASURE OF FEES AND COSTS FOR REAL ESTATE INVESTMENT VEHICLES, NOVEMBER 2019; page 8

[4] FINRA REGULATORY NOTICE 20-21; page 6

[5] SEC PRIVATE FUND ADVISERS; DOCUMENTATION OF REGISTERED INVESTMENT ADVISER COMPLIANCE REVIEWS; page 331

[6] SEC PRIVATE FUND ADVISERS; DOCUMENTATION OF REGISTERED INVESTMENT ADVISER COMPLIANCE REVIEWS; page 333

[7] SEC PRIVATE FUND ADVISERS; DOCUMENTATION OF REGISTERED INVESTMENT ADVISER COMPLIANCE REVIEWS; page 24

[8] SEC PRIVATE FUND ADVISERS; DOCUMENTATION OF REGISTERED INVESTMENT ADVISER COMPLIANCE REVIEWS; page 44

[9] SEC PRIVATE FUND ADVISERS; DOCUMENTATION OF REGISTERED INVESTMENT ADVISER COMPLIANCE REVIEWS; page 137