This article is the first in a series outlining the process of establishing a European fund, types of fund structures, and domiciles to consider, as well as the potential challenges and pitfalls along the way.

Why set up a fund in Europe?

The European Alternative Investment Fund (AIF) market continues to expand, reaching almost 6 trillion euros in net asset value, primarily attributed to the launch of new AIFs[1]. With more than 3,900 institutional investors, the European Union (EU) offers tremendous potential to U.S. fund managers looking to expand their investor base[2]. As a result, non-European fund managers are increasingly looking to Europe for new opportunities to expand their product set and bring in additional sources of capital.

While many aspects of fund establishment and administration are similar in the U.S. and Europe, there are important legal, structural, and operational differences to be considered. While there is harmonisation across the EU, local jurisdictional nuances exist. Navigating the EU landscape may seem daunting and complex at first but launching a fund in Europe may be faster and more straightforward than you might think.

Ireland has a fast-track 24-hour approval process for alternative investment funds and Luxembourg has the Reserved Alternative Investment Fund (RAIF) which is not regulated and can be launched once a regulated Alternative Investment Fund Manager (AIFM) has been appointed.

The path to establishing a fund is well trodden and there is a deep pool of service providers. Making careful and informed decisions about fund operations, structure, and domicile—along with choosing experienced partners from the beginning—will lead to a smooth launch of a European fund even for managers entering the market for the first time

To recap, once you have identified a demand for your investment strategy and made the decision to launch a fund in Europe, the process for launching that fund is quite prescriptive and straightforward in the main fund domiciles of Luxembourg, Ireland, and The Netherlands.

Choosing a launch strategy and structure: offshore versus EU

When considering a launch strategy, there are two ways for U.S. fund managers to enter Europe—offshore or European-domiciled funds.

Offshore non-EU funds attract EU investors by utilising National Private Placement Regimes (NPPRs) or relying on reverse solicitation from EU investors. Offshore funds must comply with certain aspects of European regulatory regimes such as the Alternative Investment Fund Managers Directive (AIFMD) and country-specific restrictions on private placements and marketing.

Marketing an offshore fund in the EU can be a challenge because regulations and restrictions are not consistent across countries necessitating a country-by-country approach which is expensive and time-consuming.

Finally, offshore funds may be unavailable to some investors potentially limiting a successful fundraise.

Most U.S. fund managers opt for setting up an EU-domiciled fund. This places the fund under the scope of the EU’s regulatory framework while providing access to an extensive base of investors across European countries. EU-domiciled funds established under AIFMD can offer flexibility in investment strategies and fewer restrictions covered under custody, management, and risk requirements. These funds include strategies like real estate, distressed debt, and private equity, offering investors opportunity for growth and diversification.

Fund Structures

.jpg)

Given the high levels of dry powder in the EU, managers stand to gain a huge amount by entering the EU market. Since many U.S. based fund managers already have some offshore entities in domiciles such as the Cayman Islands, BVI, or Bermuda, they are quick to try to utilise those entities to enter the EU market. While the traditional master feeder structure can work in some circumstances, it may ultimately limit the potential European investor base.

Another structure option is to launch a parallel fund targeting European investors. This can work well to target certain European investors (pension plans, for instance) that only invest in onshore funds. However, parallel structures come with high operational burdens to manage allocations across multiple entities. Unless the EU parallel fund raises enough capital, it may not be worth the cost and effort.

Finally, U.S. managers can launch a European master feeder fund. With the right partners and guidance, this structure offers the opportunity for the fund manager to continue to raise capital from its U.S. investor base, while also expanding to efficiently market across a wide range of EU institutional investors.

Marketing Considerations

The market for non-EU alternative funds is significant, with a net asset value of 1.3 trillion euros and more than one-fifth of the AIF market[3]. However, in addition to legal, structural, and cultural differences, marketing in Europe can be daunting without an EU-domiciled fund. Marketing an offshore fund is challenging because marketing and distribution regulations are different from country to country and non-EU domiciled funds are ineligible for a European “passport” that allows the fund to market across all EU member states.

Offshore-domiciled funds must take a country-by-country approach to marketing, which can prove both expensive and inefficient. Some institutional investors are not eligible to participate in funds structured offshore, reducing the potential investor base. In most cases, EU funds are unable to act as feeder funds in a master-feeder structure if the master is located offshore, necessitating a parallel structure to reach European investors.

Domicile and legal structure considerations

The most prominent domiciles for alternative funds include Luxembourg, Ireland, and The Netherlands. All have developed significant specialised resources dedicated to supporting the alternative fund sector, including banks, depositaries, administrators, tax advisors and legal experts. Fund managers generally base the decision of where to domicile on the type of fund to be established, where investors are located, or the regulatory differences between areas.

LUXEMBOURG

Luxembourg is largest fund center in world after the U.S. and the largest in Europe with over 1 trillion euros in AUM in alternative investment funds[4]. With its multilingual, international environment, AAA-rated Luxembourg has grown popular because of positive operational and legal considerations. Further, Luxembourg’s politically stable government makes it very reliable for long-term planning. Prominent fund structures include:

The Reserved Alternative Investment Fund (RAIF): These funds are like specialised investment funds (SIF) without the need for Commission de Surveillance du Secteur Financier (CSSF) approval prior to launch, allowing a shorter time to market

The Special Limited Partnership (SLP): Like U.S. partnerships, the limited partner’s liability is limited to their contributed participation interest while the general partner is liable for commitments of the company on their private assets and property.

IRELAND

Ireland is frequently the top pick for U.S. fund managers for reasons of language and culture, proximity to the U.S. with multiple daily direct flights., and expertise with both traditional and non-traditional fund structures. More than 17,000 people are employed in the funds and asset management industry in Ireland, about a quarter devoted to alternative funds.[5] With a reputation for innovation and a highly skilled workforce, Ireland is of particular interest to alternative investment funds. Prominent fund structures include:

Irish Collective Asset-Management Vehicle (ICAV): This corporate vehicle is used for both open- and closed-end funds. ICAV accounts can be prepared using a variety of accounting standards including U.S. GAAP.

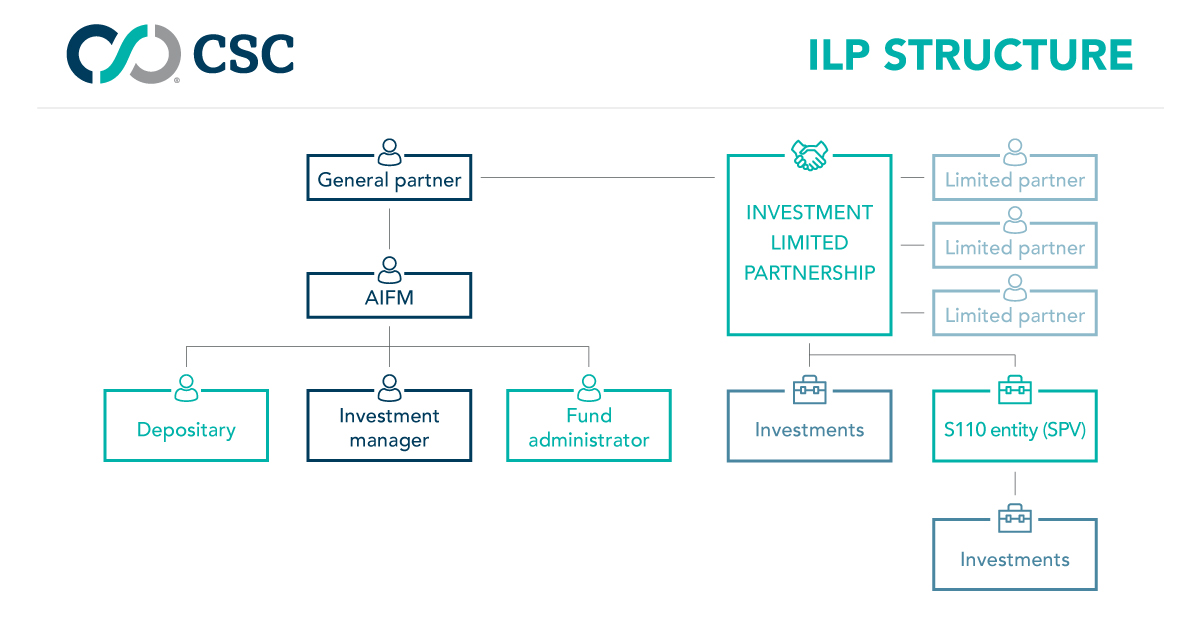

Investment Limited Partnership (ILP): This competitive solution for managers of private equity and credit, real assets, and other private and alternative fund strategies includes benefits like availability of AIFMD passports, and migration from other jurisdictions. Typically, U.S. managers are most familiar with similar partnership structures such as Delaware LPs.

THE NETHERLANDS

The Netherlands is strategically located near Europe’s most lucrative markets and provides an attractive, business friendly tax and legal framework for fund managers seeking to enter the European market. With over 1 trillion euros AUM in alternative investment funds, it’s Europe’s fastest-growing hub for finance innovation and fintech and very well-known for its ecosystem for startups and VC funding. Also, The Netherlands is leading the way on environmental, social and governance (ESG) and impact funds. Prominent fund structures include the CV and the Coop which are generally used for private equity funds, and the FGR which is generally used for real estate funds, debt funds, and hedge funds.

Commanditaire Vennootschap (CV)

The CV is a limited partnership between one or more managing partners with unlimited liability and one or more limited partners with limited liability. A CV is not a separate legal entity distinct from its partners and has no legal personality. Investors participate in the CV as limited partners and receive a limited partnership interest in the investment fund. Substantially all terms and conditions of an AIF can be laid down in the limited partnership agreement of the CV.

Coop

A Coop is a special form of association and is a separate legal personality from its members with legal title and beneficial ownership of its assets. It is often used for real estate investment funds. Investors participate in the Coop as members and hold membership interests. One of the advantages of Coop is that they can limit the liability of the participants The terms and conditions of the investment fund are outlined in a membership agreement and the articles of association of the Coop.

Besloten vennootschap (BV)

A Dutch BV is a private company with limited liability and is the preferred legal form for privately held companies in the Netherlands. A BV is incorporated by notarised deed of incorporation that includes Articles of Association. This includes company name, city, and purpose as well as the issued share capital and paid-in capital, par value(s) of stock, and conditions for share transfer.

Fonds voor Gemene Rekening (FGR) and Dutch Stichting

An FGR is not a legal entity but a contractual arrangement sui generis between a fund manager and each investor, obliging the fund manager to invest and manage assets contributed by the participants for their joint account. Generally, the legal ownership of the FGR assets is held by a separate legal entity such as a Dutch Stichting. The FGR is not dealt with in Dutch corporate law. Parties are free to determine the financial and governance structure of an FGR, which is established by the execution of a notarial or private deed setting out its terms and conditions.

Choosing Partners

While understanding differences in legal structures, operations, regulatory regimes, and culture is essential to launching a fund in Europe, the most important aspect is the partners you choose. The four most critical partners are the AIFM, depositary, fund administrator, and legal counsel.

An AIFM provides portfolio and risk management and ensures compliance with the AIFMD to market the fund across the EU. The AIFMD was implemented in Europe in 2013 and provides a regulatory framework to protect investors with strict compliance about conflicts of interest, liquidity profiles, and renumeration policies.

Appointing a depositary is required under the AIFMD regime. Their responsibilities include cashflow monitoring, safekeeping of assets, and general fund oversight. General oversight ensures the fund is operating in accordance with regulatory requirements and the conditions of its offering document.

The fund administration role is responsible for accounting, preparing, and distributing annual financial statements, coordinating audits, handling regulatory reporting, and creating periodic NAV reports for investors. Because European laws that impact alternative funds continue to evolve it’s important to select a fund administrator with global expertise that understands the market from the point of view of U.S. requirements.

Legal counsel is especially critical in the first stages of establishing a fund when initial decisions regarding structure and domicile are made. The role requires extensive experience advising funds and asset managers regarding fund formation, legal aspects of investment strategies, tax issues, and regulatory and compliance concerns. Many of the largest U.S. law firms have offices in the key fund centers in Europe, including Luxembourg, Ireland, London, and The Netherlands.

How we can help

CSC helps managers of the most complex funds across the globe meet their regulatory and investor requirements. We have relationships with more than 60% of the top 100 global alternative asset managers, providing best-in-class solutions to clients of every size across fund types, jurisdictions, and corporate and partnership structures. CSC maintains an extensive network of professionals across jurisdictions and regions and can connect your firm with whatever is needed for your specific requirements.

Alternative investment fund managers domiciling or marketing funds in the EU are generally required to appoint a depositary. Many rely on CSC’s flexible and pragmatic depositary solutions. We tailor our solutions to fit your existing infrastructure, operational environment, and investment process.

At CSC we support funds in all major financial centers—including, but not limited to, Delaware, Ireland, Luxembourg, The Netherlands, U.K., Singapore, Hong Kong, Cayman Islands, Bermuda and BVI.

[1] ESMA Annual Statistical Report on EU Alternative Investment Funds 2022

[2] Preqin 2022

[3] ESMA Annual Statistical Report on EU Alternative Investment Funds 2022

[4] ALFI estimate Q1 2022