Alongside the depth and breadth of expertise now required to administer the fund life cycle for closed-end funds, the technology required has also evolved. In 2019, a survey found that 42% of fund managers used spreadsheets to manage fund accounting.[1] Today, the vast majority rely on specialized accounting and reporting platforms.

Specialized technology

The amount of investor, portfolio-company, and fund data required to be securely collected, stored, and shared has created a need for a technology ecosystem that supports and connects the entire fund life cycle. Central to this ecosystem is the fund accounting and administration platform, which safeguards the fund’s official books and records and connects verified data to various downstream portals and workflows. Other core technologies that drive the fund life cycle include:

- Fundraising data rooms to protect the privacy of potential investors and the security of confidential data while accelerating the time to close

- Know Your Customer platform to streamline the collection of investor information and the review of subscription documents while adhering to General Data Protection Regulation (GDPR) and other data protection laws

- Entity management software to ensure global entity governance and enhance compliance

- Trust and agency software that delivers bespoke solutions for credit instruments and side collateral

- Investor portal to provide interactive, granular access to fund and portfolio company data

- Automated workflows to streamline interactions between fund managers and service partners

- Document management system to provide secure delivery of fund documents to investors and sensitive file exchange between fund managers and service partners

The sheer variety of technologies required to streamline and support the life cycle has given rise to a valuable innovation offered by select fund service companies: single sign-on portals that consolidate and organize these technologies into a unified dashboard interface. This functionality greatly enhances efficiency and visibility for the fund manager.

End-to-end orchestration

The complexities of the fund life cycle demand the expertise of lawyers, tax specialists, regulatory specialists, trustees, agents, and administrators. Finding a partner capable of delivering a complete service ecosystem offers substantial advantages over an approach that assembles these services in a piecemeal fashion from multiple providers.

- Risk reduction. When information is collected from or relayed to separate service providers, it introduces unnecessary risk. Miscommunication or misinterpretation can degrade information, while data that is shared digitally across platforms or via email can become a security and privacy risk. When the information remains within a single fund service ecosystem, it enhances accuracy and security.

- Timeliness. When domain experts are embedded in the same operational ecosystem, it accelerates service execution and reporting. Rather than relying on different organizations to coordinate actions and consolidate information, managers can work with a single provider that coordinates across domains.

- Accountability. Instead of managing relationships with multiple providers, fund managers can rely on a single point of contact to coordinate with domain experts and provide ultimate accountability for responsiveness and service quality.

The fund service ecosystem

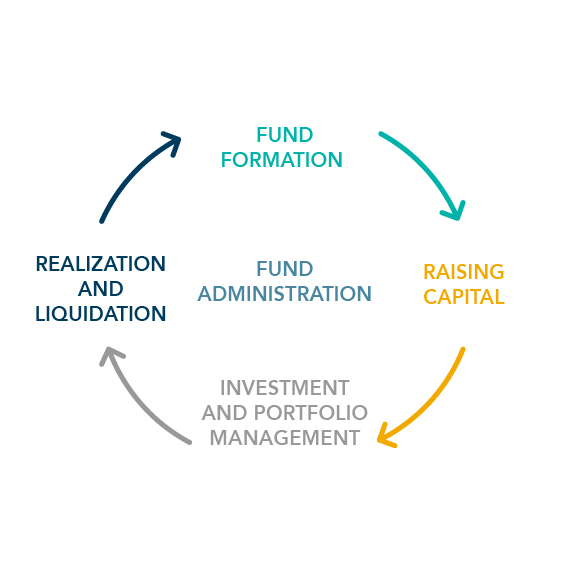

A fund manager’s long-term success depends on the availability of a service ecosystem that supports each phase of the fund life cycle with the right mix of accounting, administration, governance, and investor services.

Fund Formation

- Corporate and legal services

- Entity formation and management

- Annual reports

- Partnership representative

- Qualified custodian

- Trustee

Raising Capital

- Anti-Money Laundering and Know Your Customer compliance

- Subscription document review

- Global tax compliance

- Independent escrow agent

Investment and Portfolio Management

- Special purpose vehicle management

- Corporate secretarial services

- Officers and directors

- Delaware Statutory Trust

- Qualified custodian

- Bond trustee

- Loan agent

- Escrow agent

- Collateral agent

Realization and Liquidation

- Liquidating trustee

- Delaware Statutory Trust trustee

- Disbursing and information agent

Fund Administration

- Fund accounting

- Financial reporting

- Capital management

- Investor services

- Audit and tax support

- Alternative Investment Fund Management company and Depositary service

There has been no shortage of exhilarating highs in private capital over the years, but the asset class is now entering an exciting new phase. After consistently delivering exceptional returns, private, closed-end funds have evolved to the point that new levels of risk mitigation and operational transparency are achievable, attracting an even broader investor base and significantly more capital.

Today’s investors are looking beyond returns and choosing to invest not only in the potential for alpha but in operational transparency and trust. Fund managers must focus as much on building a reputable, consistent brand in the marketplace as they do on identifying investment opportunities. To succeed, they must evolve from a “fund launch” to a “fund life cycle” mentality and assemble a service and technology ecosystem capable of elevating the investor experience, enhancing operational efficiency, and laying the groundwork for cross-asset class and cross-jurisdictional agility.

Those that embrace private capital’s next quantum leap will find themselves in an enviable position ahead of the competition, top of mind for investors, and ready to support growth on a global scale.

Read the full insight report: The Next Evolution in Private Capital

How CSC helps

CSC is the trusted partner of choice for more than 90% of the Fortune 500®, more than 90% of the 100 Best Global Brands®, and more than 70% of the PEI 300. We provide tailored administration and strategic outsourcing solutions to support the complex world of alternative asset managers across jurisdictions and asset types while adhering to global regulations and compliance.

Founded in 1899 and headquartered in Wilmington, Delaware, U.S., CSC prides itself on being privately held and professionally managed for more than 120 years. CSC has office locations and capabilities in more than 140 jurisdictions across Europe, the Americas, Asia Pacific, and the Middle East. We are a global company capable of doing business wherever our clients are—and we accomplish that by employing experts in every business we serve. We are the business behind business®.

[1] EY, Global Private Equity Survey, 2019.