Ireland is the fastest growing European domicile for funds, accounting for 18.5% of all European fund assets. Net assets in Irish domiciled funds reached 4.1 trillion euros in 2021, with 310 billion euros in net sales[1]. Ireland’s more than three decades of experience and 17,000+ professionals serving the industry make it very attractive to fund managers, particularly with its proven expertise in alternative funds.

The Investment Limited Partnership (ILP) is Ireland’s flagship partnership structure for fund managers looking for solutions in private equity, private debt, real estate, infrastructure, credit, and other real asset investment strategies. Although it is the new kid on the block, activity is expected to increase as fund managers become more familiar with legislation updated by the Irish government in mid-2020, raising the ILP to the standard of other European jurisdictions.

In combination with Ireland’s favorable common law legal structure, the amended ILP brings considerable benefits to the industry and offers Ireland the opportunity to position itself competitively with leading alternative investment fund jurisdictions including the Cayman Islands, Luxembourg, and Delaware. It will also allow U.S. fund managers already familiar with limited partnership structures to benefit from the transparency and openness of the Irish regulatory environment and tax regime.

ILPs are regulated by the Central Bank of Ireland (CBI), and Alternative Investment Fund Managers Directive (AIFMD) regime and are generally formed as a Qualifying Investor Alternative Investment Fund (QIAIF) marketed to qualifying investors.

The structure

Features, benefits, and advantages

An ILP is the structure of choice for most asset managers in the alternative fund space. The Irish government’s 2020 legislation update regarding ILPs makes the offering more attractive to asset managers with several enhancements aligning the ILP with the Cayman Islands Exempt Partnership, the Delaware Limited Liability Partnership, UK Limited Partnerships, and the Luxembourg Special Limited Partnership.

Availability of AIFMD passporting

With an authorised alternative investment fund manager (AIFM) an ILP may be marketed to professional European investors across the EU and the European Economic Area (EEA). They can also delegate portfolio management and risk management to a non-EEA investment manager under the provisions of AIFMD.

Easy migration from other jurisdictions

The new legislation allows for straightforward migration into Ireland from other fund jurisdictions using limited partnership structures. Crucially in this scenario, a fund migrating from another jurisdiction will keep its performance and financial proven track records.

Limited partners

There are no restrictions on the number of LPs admitted to an ILP. The liability of an LP for the debts and obligations of the ILP is limited to the value of its capital contributed or committed, except where an LP is involved in the ILP’s management. The legislation includes an allowlist of activities that can be performed by LPs without affecting their limited liability status. The assets, liabilities, and profits of an ILP belong jointly to the partners in the partnership agreement’s proportions.

Sustainable investment focus for ILPs

Flexibilities in borrowing, speed-to-market, and investment restrictions make ILPs an attractive option for alternative environmental, social, and governance (ESG) focused funds. With the European Commission’s Green Deal to make Europe the first climate-neutral continent by 2050 in mind, ILP funds are expected to be at the forefront of alternative sustainable investment funds in the foreseeable future.

The opportunity for growth in Ireland’s alternative investment fund industry is significant following the ILP legislation’s introduction. The arrival of new fund managers from other jurisdictions will be pushing on an open door—the experience and expertise within Ireland in this space is comparable with any around the world.

Other advantages include:

- CBI 24-hour authorisation process

- No investment, leverage or borrowing restrictions for QIAIF ILPs

- Tax transparency (no tax disadvantage to hold assets through structure rather than direct)

- LP contractual breach is not deemed to be penal or enforceable

- LPs are not liable for ILP obligations beyond the amount of capital contributed

Additional considerations and requirements

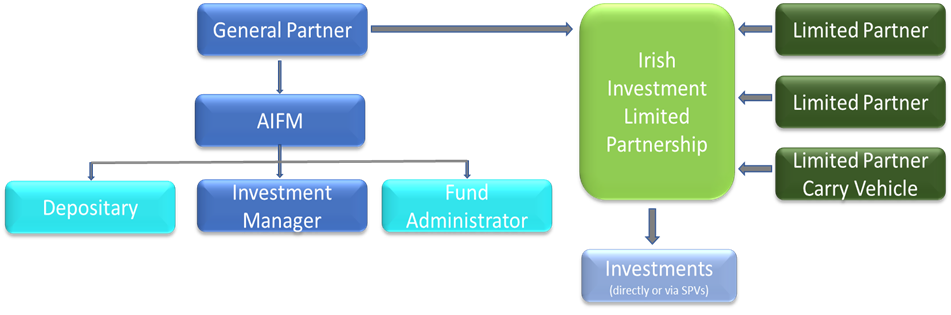

The key participants in an Irish ILP include an AIFM, investment manager, fund administrator, and depositary. The AIFM can be EU-authorised, Irish registered, or non-EU and must be authorised by the CBI to act.

If managed by an EU-authorised AIFM, the fund can be marketed throughout the EU using the AIFMD passport.

If an Irish registered, or non-EU AIFM is used, no marketing passport is available, and they can use only national private placement rules where available.

The investment manager, fund administrator, and depositary must be authorised by the CBI as well.

If a separate distributor or placement agent is appointed by the AIFM, they must have the required license to market in the jurisdiction. Ensure that the placement agent retains such licenses throughout the fund-raising period.

How CSC helps

Our fund administration and depositary services together with our special purpose vehicle and agency and trustee services teams provide a solution tailored to suit the needs of our clients. With a deep understanding of the alternative funds industry our team streamlines the process to provide a seamless experience for our clients with an unflinching focus on providing a consistent quality of service. We offer end-to-end solutions across our full suite of services. We can help with:

- Fund Administration and transfer agency

- Depositary

- Special Purpose Vehicle, Section 110, and holding company management

[1] CBI and EFAMA data Q4 2021